Inox Wind |3QFY2019 Result Update

February 13, 2019

INOX Wind Ltd.

BUY

CMP

`68

Target Price

`110

Quarterly (` cr)

Q3FY19

Q3FY18

% yoy Q2FY19

% qoq

Net sales

391

91

330%

437

-11%

Investment Period

12 Months

EBITDA

61

-18

-439%

53

15%

EBITDA margin (%)

15.7%

-19.8%

3548

12.13%

352

Stock Info

Adjusted PAT

1.67

-46.12

-103.6%

1.52

10%

Sector

Capital Goods-Wind

During the quarter under review, Inox Wind Ltd’s (IWL) revenue de-grew by 11% on qoq

Market Cap (` cr)

1,509

Beta

1.0

basis due to lack of availability of substation for SEC-I & II orders, however situation has

52 Week High / L

139.9/56.8

improved since February, and management expects to increase the commissioning activities,

Avg. Daily Volume

77,291

Face Value (`)

10

once substation is ready. On the margin front, EBIDTA margin improved to 15.7% in

BSE Sensex

36,153

Q3FY19 as compared to 12% in previous quarter on account of stock adjustment.

Nifty

10,831

Reuters Code

INWN.BO

o IWL has supplied component of 75MW during the quarter.

Bloomberg Code

INXW IN

o During the quarter, IWL has received LOI of 501.6MW for current SEC-I-III, IV, V,

VI and upcoming auction under SECI from Adani Green Energy.

Shareholding Pattern (%)

o Recent issue of land allocation in Gujarat has delayed the execution of few SEC-I

Promoters

75.0

orders, however, post intervention of Ministry of New and Renewable Energy,

MF / Banks / Indian Fls

0.8

Gujarat state government has come up with land allocation policy. We expect the

FII / NRIs / OCBs

7.5

situation will improve going forward.

Indian Public / Others

16.8

o Key things to watch out for in the near term are (a) execution pick up, (b) resolution

of land allocation issue and (c) order inflow. However, by looking at the

government’s ambitious target to auction 10GW of wind capacity every year till

Abs.(%)

3m 1yr Since Listi

FY2028, our outlook for the sector is positive in the long term.

Sensex

3.8

6.3

25.2

INOX Wind(22.1)

(45.1)

(84.5)

Outlook and Valuation: Considering the changing dynamics of renewable energy

consumption and government’s thrust to auction 10GW wind capacity by year 2028, we

are bullish on the sector, and hence, have a positive outlook on IWL. At the CMP of

Performance charts since listing

`68, stock is available at PE multiple of 5.3x its FY2020E EPS of `13. We recommend a

BUY with revised target price from `120 to `110 on account of delay in commissioning

500

450

of order.

400

350

300

Key Financials

250

200

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

150

Net Sales

4,451

3,415

480

1,505

3,416

100

50

% chg

65

(23)

(86)

214

127

0

Net Profit

461

303

(188)

61

287

% chg

(30)

(34)

(162)

(133)

367

EBITDA (%)

16.0%

16.4%

-17.0%

15.0%

15.0%

Source: Capitaline, Angel Research

EPS (Rs)

21

14

(8)

3

13

P/E (x)

3

5

(8)

25

5.3

P/BV (x)

0.8

0.7

0.8

0.7

0.6

RoE (%)

24.4

13.9

(9.4)

3.0

12.2

Kripashankar Maurya

RoCE (%)

20.4

13.9

(4.7)

5.9

14.2

022 39357600, Extn: 6004

EV/EBITDA

3.1

4.2

(22.6)

4.7

3.2

Source: Company, Angel Research; Note: CMP as of February 12, 2019

February 13, 2019

1

Inox Wind |3QFY2019 Result Update

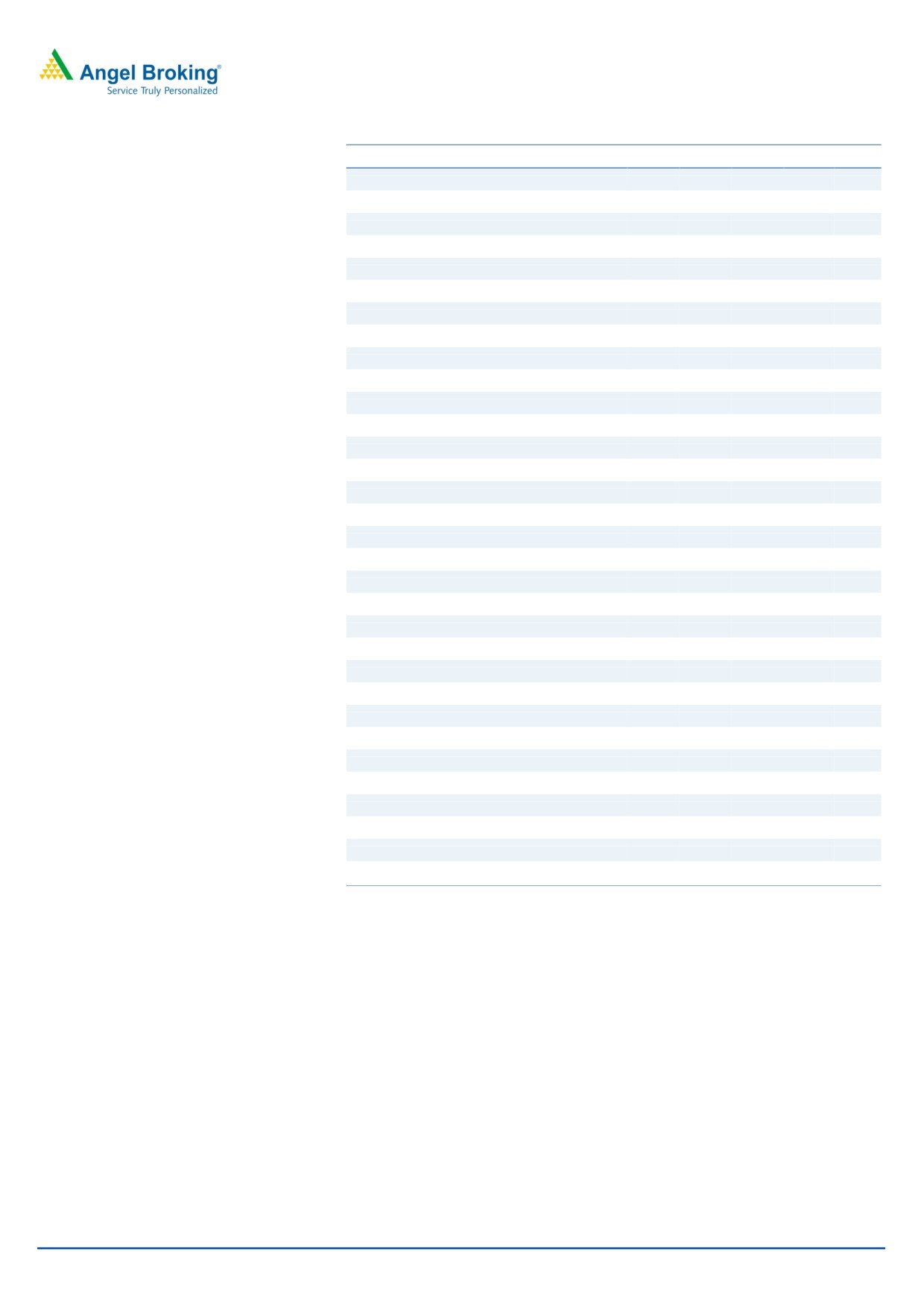

Exhibit 1: Q3FY19 Performance

In INR Cr

Q3FY19 Q3FY18 Q2FY19

YOY % QOQ%

Net Sales

391

91

437

330%

-11%

Total Income

391

91

437

330%

-11%

Total Expenditure

330

109

384

203%

-14%

Raw Material Consumed

250

14

265

1727%

-6%

Stock Adjustment

-24

19

-4

NA NA

Purchase of Finished Goods

0

0

0

NA NA

COGS

225

33

261

584%

-14%

(Profit)/ Loss on Forex Transaction

-10

-2

5

Employee Expenses

22

24

24

-7%

-6%

EPC,O&M, and common Infra Facility expenses

41

30

27

35%

48%

Other Expenses

51

24

66

112%

-23%

As a % of sales

Raw Material Consumed

64%

15%

61%

Stock Adjustment

-6%

21%

-1%

Purchase of Finished Goods

0%

0%

0%

COGS

90%

241%

98%

Gross Margin %

42%

64%

40%

(Profit)/ Loss on Forex Transaction

-3%

-2%

1%

0%

0%

Employee Expenses

9%

176%

9%

Other Expenses

20%

176%

25%

EBITDA

61

-18

53

-439%

15%

Other Income

3.23

3.8

5.3

-15%

-39%

Interest

45.44

40.6

39.3

12%

16%

PBDT

18.95

-54.86

18.93

NA

0%

Depreciation

16.23

13

16

21%

-2%

PBT

2.72

-68.26

2.44

NA

11%

Tax

1.05

-22

1

NA

14%

PAT

1.67

-46.12

1.52

NA

10%

Ratios

BPS BPS

EBITDA margin (%)

16%

-20%

12%

3548

351.77

PAT margin %

0%

-51%

0%

5115

8

Tax rate %

39%

NA

38%

NA

90

Source: Company, Angel Research

Q3FY2019 Key highlights of the quarter

During the quarter under review, Inox Wind Ltd. (IWL) has reported de-growth

in revenue on qoq basis at `391cr from `437cr in Q2FY2019. However,

EBIDTA/ PAT (`61cr, up 15% qoq/ `1.67cr, up 10% qoq,) despite challenging

environment.

EBIDTA margin increased to normal levels at 15.7% in Q3FY2019 as

compared to 11.7% in last quarter on account of stock adjustment and gain in

forex transactions.

Management expects speeding of commissioning activity from Q4FY2019 and

Q1FY2020 onwards due to availability in substation for SEC-I and II orders.

February 13, 2019

2

Inox Wind |3QFY2019 Result Update

IWL has supplied 75MW of component quarters, 244MW of orders are yet to

be commissioned, which will happen over the next couple of months.

Valuation

Considering the changing dynamics of renewable energy consumption and

government’s thrust to auction 10GW wind capacity by year 2028, we are bullish on

the sector, and hence, have a positive outlook on IWL. At the CMP of `68, stock is

available at PE multiple of 5.3x its FY2020E EPS of `13. We recommend a BUY with

revised target price from `120 to `110 on account of delay in commissioning of orders.

Risks to our estimates

Delay in auction

Any delay in auction of wind energy may lead to slowdown in sector, and hence, create

an uncertainty in revenue visibility.

February 13, 2019

3

Inox Wind |3QFY2019 Result Update

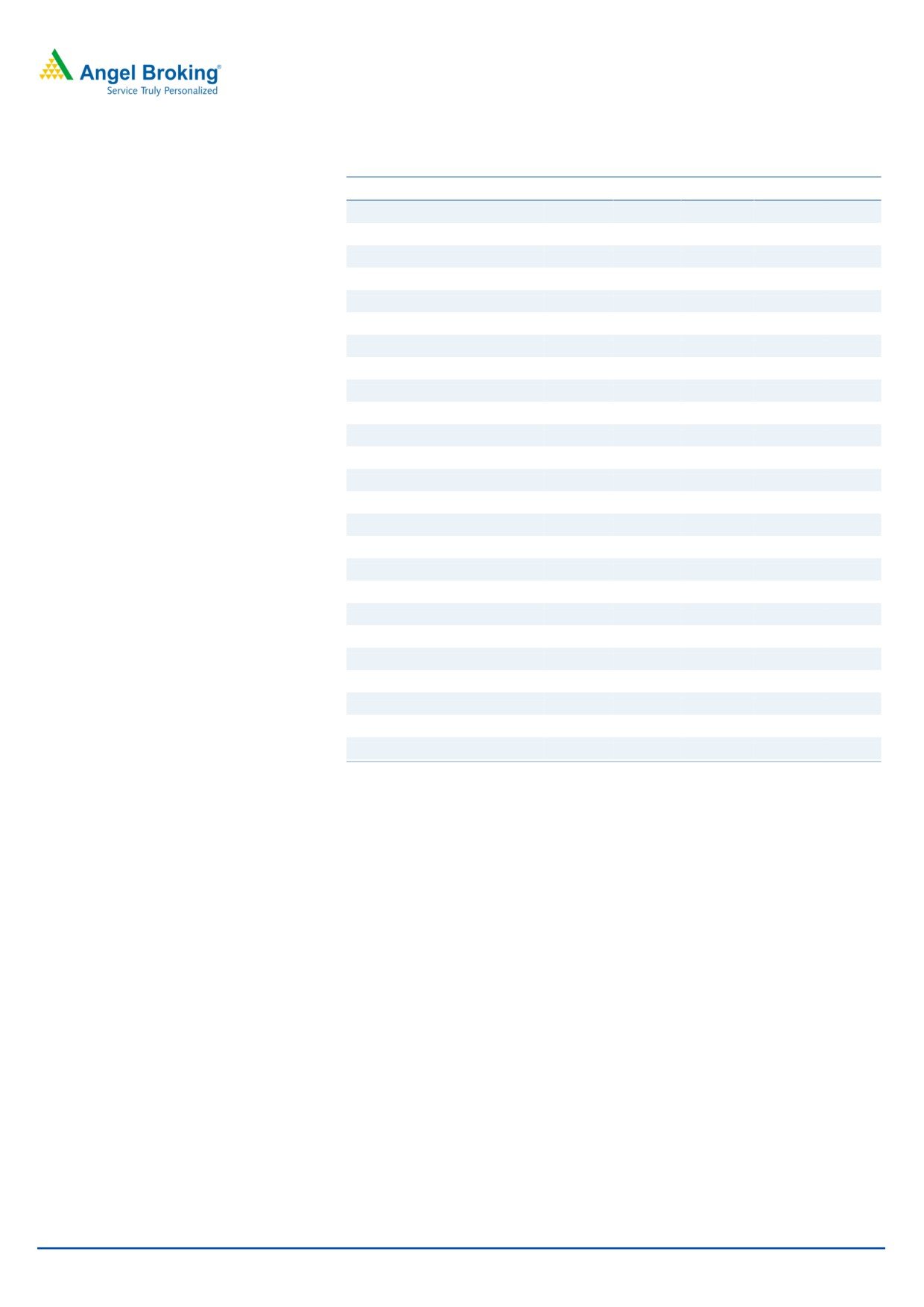

Income statement

Y/E March (` cr)

FY16

FY17

FY18

FY19E

FY20E

Total operating income

4,451

3,415

480

1,505

3,416

% chg

65

(23)

(86)

214

127

Total Expenditure

3,737

2,855

561

1,280

2,903

Raw Material

2,716

1,920

47

933

2,118

Personnel

92

117

100

30

68

Loss on Forex Transaction

21

-19

-1

-

-

Others Expenses

908

836

416

316

717

EBITDA

713

560

-81

226

512

% chg

(22)

(21)

(115)

(378)

127

(% of Net Sales)

16.0%

16.4%

-17.0%

15.0%

15.0%

Depreciation& Amortisation

36

44

52

55

59

EBIT

677

517

-134

171

453

% chg

(25)

(24)

(126)

(228)

165

(% of Net Sales)

15

15

-28

11

13

Interest & other Charges

98

155

171

115

95

Other Income

70

65

24

27

29

Extraordinary Items

-

-

-

Recurring PBT

649

427

-280

83

387

% chg

(24)

(34)

(166)

(130)

367

Tax

188

124

-93

22

101

PAT (reported)

461

303

-188

61

287

% chg

(46)

(34)

(162)

(133)

367

(% of Net Sales)

10.4

8.9

-39.1

4.1

8.4

Basic & Fully Diluted EPS (Rs)

21

14

-8

3

13

% chg

(97)

(34)

(162)

(133)

367

Source: Company, Angel Research

February 13, 2019

4

Inox Wind |3QFY2019 Result Update

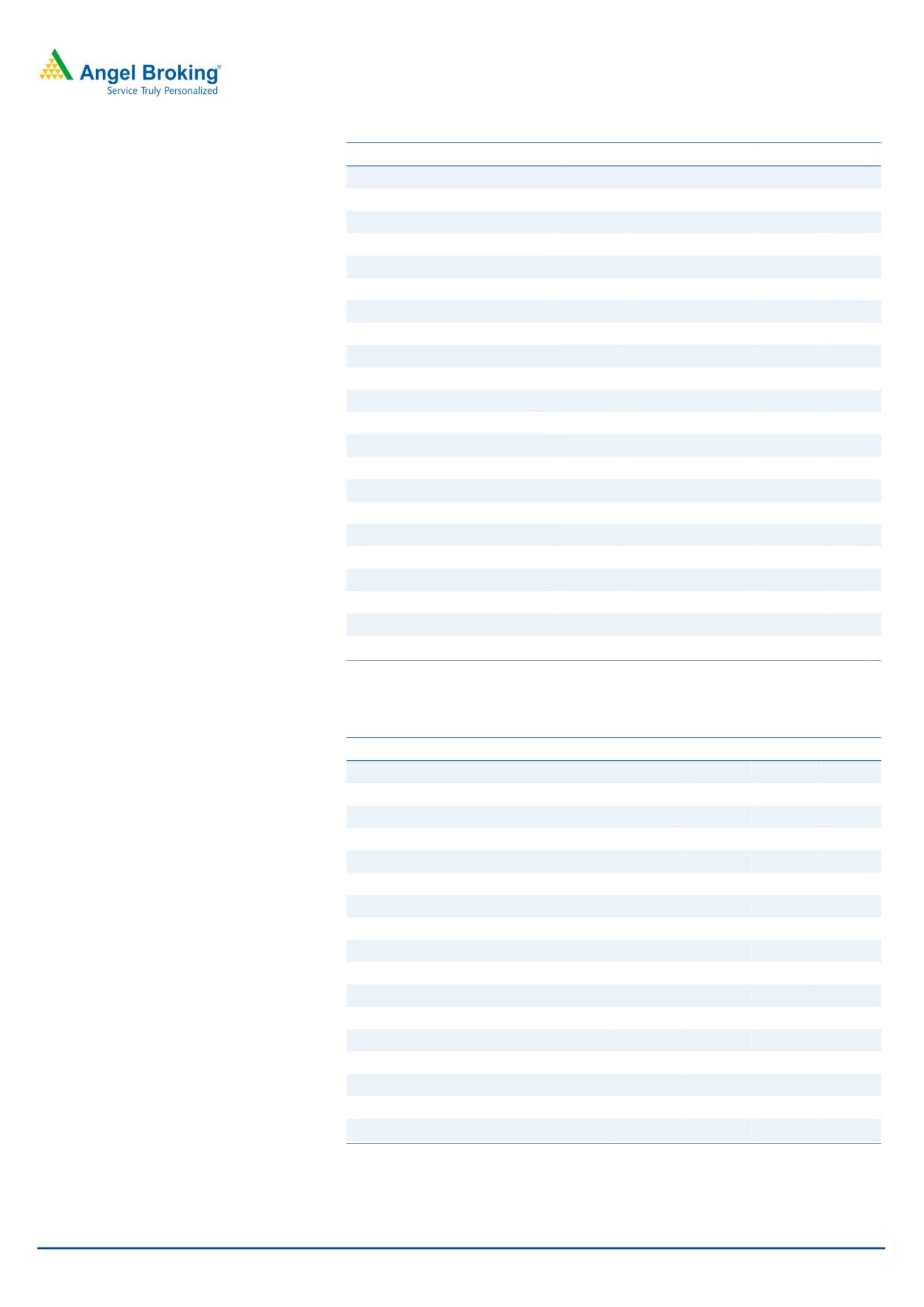

Balance Sheet

Y/E March (`cr)

FY16

FY17

FY18

FY19E

FY20E

SOURCES OF FUNDS

Equity Share Capital

221.9

221.9

221.9

221.9

221.9

Reserves& Surplus

1,665

1,968

1,782

1,844

2,130

Shareholders Funds

1,887

2,190

2,004

2,066

2,352

Total Loans

1,437

1,528

831

831

831

Other Liabilities

50

113

33

355

355

Total Liabilities

3374

3831

2868

3251

3538

APPLICATION OF FUNDS

Net Block

569

765

985

1,062

1,098

Capital Work-in-Progress

43

112

20

20

20

Investments

-

53

0

-

-

Long Term Loans & Advances

12

16

15

15

15

Current Assets

3,895

3,938

2,708

2,504

3,505

Inventories

560

690

929

309

702

Sundry Debtors

2,409

2,382

1,339

1,031

2,059

Cash

494

437

127

1,026

462

Loans & Advances

304

87

0

0

0

Investments & Others

128

341

313

137

282

Current liabilities

1,404

1,324

1,230

606

1,337

Net Current Assets

2,491

2,614

1,478

1,899

2,168

Other Non Current Asset

260

270

370

256

238

Total Assets

3374

3831

2868

3251

3538

Cash flow

Y/E March (`cr)

FY16

FY17

FY18

FY19E

FY20E

Profit before tax

649

427

(280)

83

387

Depreciation

36

44

52

55

59

Change in Working Capital

283

(436)

(669)

(568)

1,689

Interest / Dividend (Net)

98

155

171

115

95

Direct taxes paid

188

124

(93)

22

101

Others

(1,418)

(200)

1,088

1,474

(2,551)

Cash Flow from Operations

(163)

114

269

1,181

(219)

(Inc.)/ Dec. in Fixed Assets

(404)

(290)

(186)

(272)

(99)

(Inc.)/ Dec. in Investments

(31)

(111)

302

0

-

Cash Flow from Investing

(968)

(5)

332

(272)

(99)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

1,403

90

-697

-

-

Others

(901)

(71)

(63)

72

(245)

Cash Flow from Financing

501

19

(760)

72

(245)

Inc./(Dec.) in Cash

(630)

128

(159)

981

(564)

Opening Cash balances

706

76

204

46

1,026

Closing Cash balances

76

204

46

1,026

462

Source: Company, Angel Research

February 13, 2019

5

Inox Wind |3QFY2019 Result Update

Key Ratio

Y/E March

FY16 FY17 FY18 FY19E FY20E

P/E (on FDEPS)

3

5

-8

25

5

P/CEPS

3

4

-11

13

4

P/BV

1

1

1

1

1

EV/Sales

0

1

4

1

0

EV/EBITDA

3

4

-23

5

3

EV / Total Assets

5

4

3

2

3

Per Share Data (Rs)

EPS (Basic)

21

14

-8

3

13

EPS (fully diluted)

21

14

-8

3

13

Cash EPS

22

16

-6

5

16

DPS

0

0

0

0

0

Book Value

85

99

90

93

106

Returns (%)

ROCE

20

14

-5

6

14

Angel ROIC (Pre-tax)

24

16

-5

8

15

ROE

24

14

-9

3

12

Turnover ratios (x)

Inventory / Sales (days)

46

74

707

75

75

Receivables (days)

198

255

1018

250

220

Payables (days)

97

104

408

110

110

Working capital cycle (ex-cash) (days)

146

225

1317

215

185

Source: Company, Angel Research

February 13, 2019

6

Inox Wind |3QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock

Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity & Derivatives

Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has

registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI

(Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been debarred/ suspended by

SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such

investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in

this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an

investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals.

Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or

damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not

independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or

warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavors to

update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us

from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed

or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Inox Wind

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

February 13, 2019

7